Feie Calculator - Truths

The Best Strategy To Use For Feie Calculator

Table of ContentsOur Feie Calculator IdeasFeie Calculator Things To Know Before You BuyThe Best Guide To Feie CalculatorGetting The Feie Calculator To Work3 Simple Techniques For Feie Calculator

Initially, he sold his U.S. home to establish his intent to live abroad permanently and gotten a Mexican residency visa with his partner to help meet the Bona Fide Residency Examination. Additionally, Neil protected a long-term residential property lease in Mexico, with strategies to eventually purchase a home. "I presently have a six-month lease on a home in Mexico that I can prolong another 6 months, with the intention to purchase a home down there." However, Neil explains that acquiring building abroad can be testing without first experiencing the area."We'll certainly be beyond that. Also if we come back to the US for physician's consultations or company phone calls, I question we'll invest greater than 30 days in the US in any kind of offered 12-month duration." Neil highlights the value of strict tracking of united state gos to (Digital Nomad). "It's something that people need to be truly persistent regarding," he states, and encourages deportees to be mindful of usual mistakes, such as overstaying in the U.S.

The Main Principles Of Feie Calculator

tax obligation obligations. "The reason why united state tax on worldwide earnings is such a big offer is due to the fact that many individuals neglect they're still subject to united state tax obligation also after transferring." The united state is among the few countries that tax obligations its people no matter where they live, suggesting that even if a deportee has no income from united state

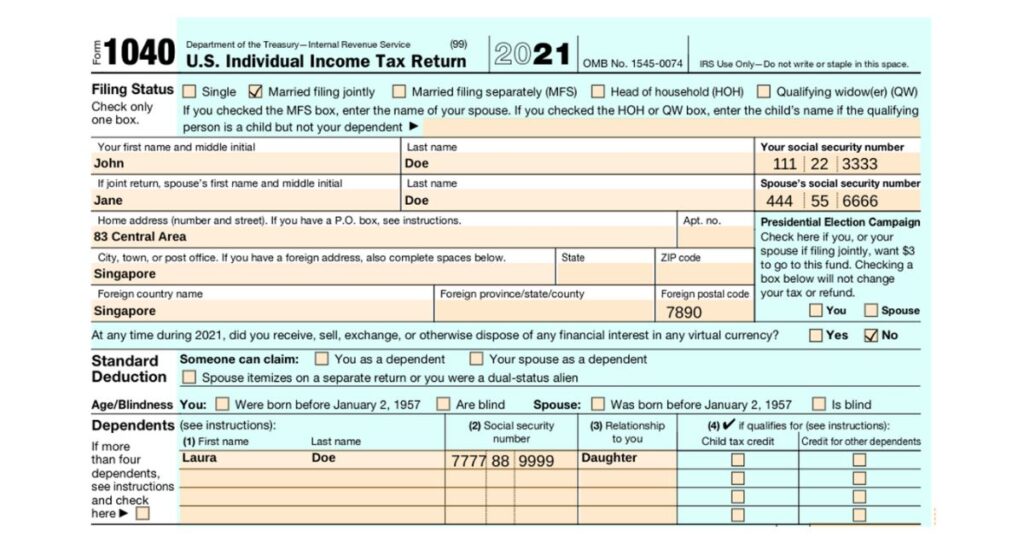

income tax return. "The Foreign Tax Credit rating allows individuals functioning in high-tax countries like the UK to offset their U.S. tax obligation responsibility by the quantity they've already paid in tax obligations abroad," claims Lewis. This ensures that expats are not tired twice on the same revenue. However, those in reduced- or no-tax nations, such as the UAE or Singapore, face additional obstacles.

Top Guidelines Of Feie Calculator

Below are some of the most regularly asked concerns concerning the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) permits U.S. taxpayers to leave out as much as $130,000 of foreign-earned income from federal revenue tax, minimizing their U.S. tax obligation liability. To certify for FEIE, you have to meet either the Physical Visibility Test (330 days abroad) or the Authentic Residence Examination (verify your primary home in an international nation for an entire tax year).

The Physical Visibility Examination needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Visibility Test also needs U.S. taxpayers to have both a foreign revenue and a foreign tax obligation home. A tax home is defined as your prime place for organization or work, despite your household's home.

See This Report about Feie Calculator

An earnings tax obligation treaty between the U.S. and an additional nation can aid protect against dual tax. While the Foreign Earned Revenue Exemption minimizes gross income, a treaty may provide added benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Report) is a needed declare united state residents with over $10,000 in foreign monetary accounts.

Eligibility for FEIE depends on meeting certain residency or physical existence tests. is a tax click for info expert on the Harness system and the founder of Chessis Tax. He belongs to the National Association of Enrolled Agents, the Texas Culture of Enrolled Professionals, and the Texas Culture of CPAs. He brings over a decade of experience functioning for Huge 4 companies, encouraging expatriates and high-net-worth individuals.

Neil Johnson, CPA, is a tax obligation expert on the Harness system and the founder of The Tax obligation Dude. He has over thirty years of experience and now focuses on CFO services, equity compensation, copyright taxes, marijuana tax and separation related tax/financial preparation issues. He is an expat based in Mexico - https://justpaste.it/2891m.

The foreign earned earnings exemptions, sometimes referred to as the Sec. 911 exemptions, leave out tax obligation on wages made from functioning abroad.

Fascination About Feie Calculator

The earnings exemption is now indexed for rising cost of living. The optimal yearly earnings exemption is $130,000 for 2025. The tax obligation benefit omits the revenue from tax at bottom tax obligation rates. Formerly, the exemptions "came off the top" reducing revenue based on tax on top tax rates. The exclusions may or might not decrease revenue used for other functions, such as individual retirement account restrictions, child credit scores, personal exemptions, etc.

These exemptions do not excuse the earnings from US taxes yet just give a tax obligation reduction. Note that a bachelor working abroad for all of 2025 that earned concerning $145,000 without any other revenue will have taxable revenue decreased to no - efficiently the very same response as being "free of tax." The exemptions are computed every day.